Jewellery Protection You Can Trust

Protect Every Piece, Every Time

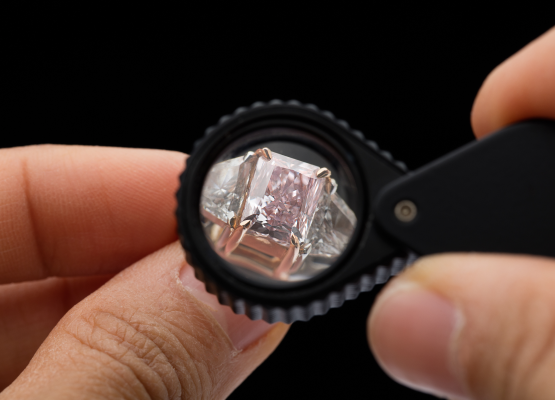

Your jewellery holds sentimental and financial value, making it more than just an accessory. Whether it is an engagement ring, a designer timepiece, or a treasured heirloom, proper insurance ensures your jewellery is protected against loss, theft, or damage.

Many home insurance policies in Ontario do not provide enough coverage for high-value jewellery, leaving owners financially exposed. Affiliated Insurance offers specialized protection that ensures your most valuable pieces are insured at their full worth, no matter where you are in Ontario or beyond.

GET A QUOTEWhy Jewellery Owners in Ontario Insure with Affiliated

- Coverage That Reflects True Value: Jewellery is an investment in craftsmanship and rarity. Our policies account for appreciation, uniqueness, and market value to ensure your collection is protected.

- More Than Home Insurance Can Offer: Many home insurance plans limit jewellery coverage, meaning you may not be fully reimbursed if an item is lost or stolen. Our jewellery insurance guarantees complete financial protection.

- Manage Your Jewellery Insurance Anytime: With our online self-service portal, you can access your policy, update coverage, or submit claims whenever needed.

- A Claims Process That Works for You: Losing or damaging a valuable piece can be stressful. Our claims team ensures that your jewellery is repaired, replaced, or reimbursed at its insured value with minimal hassle.

What Jewellery Insurance Cover

- Protection Against Theft and Loss: Coverage if your jewellery is stolen, misplaced, or lost while traveling.

- Accidental Damage Insurance: Covers repairs for broken clasps, loose stones, and other damage.

- Worldwide Insurance for Jewellery: Your coverage follows you wherever you go.

- Appraisal-Based Value Adjustments: Keeps up with the rising value of gold, diamonds, and gemstones.

- Expert Restoration and Repairs: Covers professional craftsmanship for damaged jewellery.

How Much Does Jewellery Insurance Cost in Ontario

Jewellery insurance is more affordable than most people think, typically costing between one and five percent of the insured item’s value each year.

Several factors impact pricing, including:

- Jewellery Appraisal: Higher-value items require increased coverage.

- Storage and Security: Storing jewellery in safes or secured locations may lower premiums.

- Travel and Wear Frequency: Frequently worn or transported jewellery may require additional coverage.

Affiliated Insurance offers competitive rates while ensuring that your jewellery receives full protection in Ontario.

How to Keep Jewellery Safe from Loss or Damage

Even with insurance, taking precautions can help protect your jewellery:

- Store Jewellery Securely: A fireproof, theft-resistant safe is the best place to store valuable pieces.

- Update Your Appraisals: Ensure your policy reflects current market value.

- Schedule Professional Inspections: Routine maintenance prevents loose stones and broken clasps.

- Document Every Piece: Keep receipts, certificates, and photos for accurate claims processing.

These steps help keep your jewellery secure, well-maintained, and properly valued over time.

GET A QUOTEProtecting Jewellery at Every Stage of Life

Whether starting a new collection or safeguarding family heirlooms, insurance should evolve with your needs.

- Engagement Rings and Wedding Bands: These rings symbolize love and commitment, making them some of the most cherished jewellery pieces. They are also among the most commonly lost or stolen items, making proper insurance essential.

- Luxury Watches and Designer Jewellery: A luxury watch or custom-designed piece is an investment in both craftsmanship and value. Proper insurance ensures you can repair, replace, or recover the value of your collection in case of loss.

- Inherited and Heirloom Jewellery: Passed down through generations, heirloom jewellery carries sentimental and historical value. Protecting it with expert restoration coverage and full-value reimbursement ensures that its legacy continues.

- Jewellery Collections and New Acquisitions: Your jewellery collection grows over time, and its value may increase. Regularly updating your policy ensures all new additions are properly insured.

Additional Coverage for Jewellery Collectors

- Engagement Ring Insurance: Full protection for one of life’s most meaningful purchases.

- Luxury Watch Insurance: Coverage for high-end brands, vintage timepieces, and collectibles.

- Heirloom Jewellery Insurance: Ensures inherited jewellery is preserved and covered.

- Custom Jewellery Insurance: Protection for one-of-a-kind or designer pieces.

Common Risks Jewellery Owners Face in Ontario

- Theft and Burglary: High-value jewellery is frequently targeted.

- Accidental Damage: Rings, necklaces, and bracelets can suffer from daily wear and tear.

- Loss and Misplacement: Small items can be misplaced at home or while traveling.

- Travel-Related Risks: Jewellery worn on vacation is more exposed to loss or theft.

Affiliated Insurance provides policies that cover these risks, ensuring your jewellery is protected.

Steps to Insure Your Jewellery

Getting jewellery insurance with Affiliated Insurance is easy:

- Schedule an Appraisal: Confirm your jewellery’s value with a certified jeweller.

- Choose the Right Insurance Plan: Select coverage based on the total value of your collection.

- Review Security Measures: Keeping jewellery in a secured location may reduce risk.

- Update Your Policy Annually: Ensure your coverage reflects new acquisitions and appreciation in value.

Our team will help design a policy that fits your jewellery collection’s needs.

GET A QUOTEExplore More Coverage Options

Affiliated Insurance provides protection for more than just jewellery. Explore other options:

Protect Your Jewellery with Confidence

Jewellery is meant to be worn, celebrated, and passed down for generations. Affiliated Insurance provides comprehensive coverage, expert claims support, and peace of mind so you can wear your jewellery without worry.

GET A QUOTE

Success Deserves Full Protection

High-net-worth insurance ensures that estates, luxury collections, and prized possessions remain protected:

FAQ

Most home insurance policies place limits on jewellery coverage, meaning high-value pieces may not be fully insured. Jewellery insurance provides full protection against loss, theft, and damage.

Jewellery should be reappraised every two to three years to keep your coverage up to date with market value changes.

Yes, individual pieces, such as engagement rings, luxury watches, and custom necklaces, can be insured separately.

Many jewellery insurance policies provide worldwide coverage, but reviewing the specifics of your plan before travelling is recommended.

Yes, jewellery that you wear regularly, such as engagement rings, wedding bands, and luxury watches, can be insured. Since daily wear increases the risk of loss or damage, it’s important to have a policy that covers accidental damage, theft, and misplacement.